This week: WealthTech valued at EUR 20 billion & "Middle Office" in PE

#231 - Pierre-Henri Denain (CEO France/BeLux) and #232 - Charlie Tafoya (CEO and co-founder of Chronograph)

The low-profile FinTech valued at 20 billion that is reshaping Wealth Management.

You may have never heard of it, yet this discreet company, present almost everywhere in the world, is reshaping entire segments of the wealth industry.

It all happens behind the scenes. Pierre-Henri joined me to unveil the mystery surrounding this New Zealand-originated company, which executes everything they do with perfection.

In this episode, we learn about the challenges of this fragmented market with diverse needs and see how it all works “backstage”.

We also look into the roadmap of this company with 5,000 employees operating in about thirty countries, managing 1.5 trillion USD.

FNZ

Founded in 2003 by Adrian Durham, FNZ (“First NZ Capital Group”) offers investment solutions to financial institutions and management companies in the wealth management vertical, in a “Platform as a Service” mode. The services cover the “Front”, “Middle”, and “Back Office”.

At the heart of its strategy is internationalisation. FNZ has made numerous acquisitions (one to five per year since 2018).

FNZ collaborates with life insurance companies, Banks, asset managers, and wealth managers to offer wealth management services. Among its clients are Allianz, Aviva, Barclays, Cardif, Santander, Swedbank, UBS, and Vanguard.

Shareholding Evolution

FNZ began as a department of the New Zealand subsidiary of Credit Suisse before expanding to the UK in 2005.

In 2009, FNZ underwent a management buyout supported by HIG Capital for 34 million NZD.

In 2012, General Atlantic acquired a minority stake in FNZ, followed in 2018 by the purchase of two-thirds of the company by CDPQ and Generation Investment Management, valuing FNZ at 1.6 billion GBP.

In 2020, Temasek acquired a share of FNZ, and in 2022, the company raised 1.4 billion USD from CPP Investments and Motive Partners, bringing its valuation to 20 billion USD.

Data : the lifeblood of Private Equity warfare

There is still a long way to go to transform the Private Equity (PE) industry, which relies heavily on Excel for many tasks.

These manual processes present a golden opportunity for anyone looking to innovate in the industry and help the myriad players in this ecosystem improve their efficiency and better serve their clients. I contacted Chronograph because I’ve been aware of the work they have been doing for years to streamline data management, analysis, and reporting.

This US-based solution offers a portfolio tracking software that makes life easier for investors. In this episode, Charlie shares their story and explains how the offering initially focused on LPs naturally extended to GPs. We discussed the solution and the specific problems it addresses, which form one of the three essential pillars of the “PE stack”.

“PE stack”

I covered the subject a few weeks ago with Dr André Retterath on the niche VC.

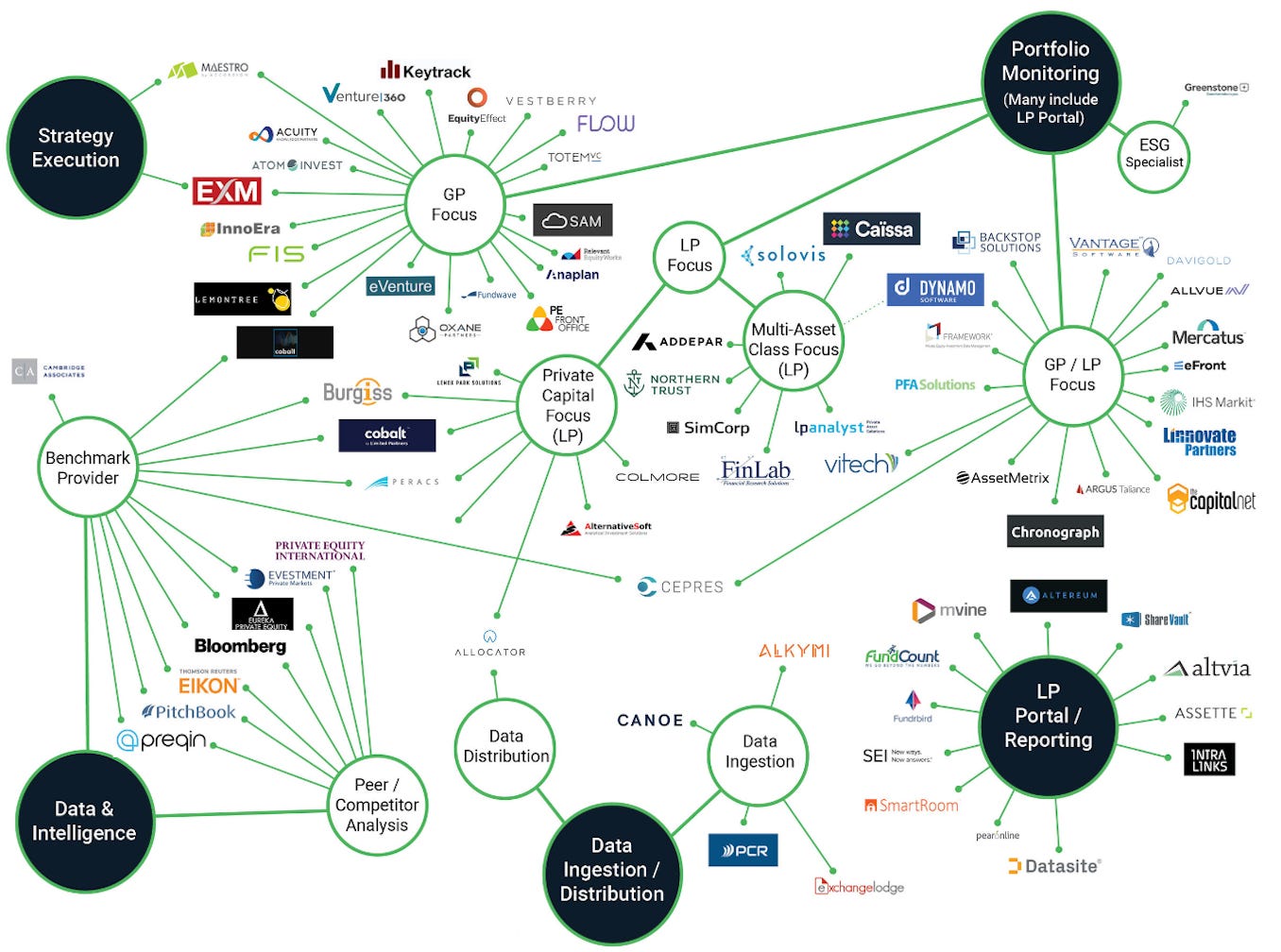

On the PE side, there are a multitude of solutions to streamline “Front, Middle, Back” processes.

The explosive growth of the industry, both in terms of size and complexity, has fostered the emergence of increasingly sophisticated tools to support LPs/GPs in monitoring and reporting their portfolios.

To give you an idea, I am sharing here a very detailed mapping of providers of these solutions for the “Middle” section (Source: “PE Stack”). It includes portfolio management, data management, and LP portals.

It includes portfolio management, data management, and LP portals.

To get more details on “Front” solutions 👉 here and “Back”, 👉 there.

Chronograph

Founded in 2016 by Charlie Tafoya and Michael Bridge, the scale-up markets portfolio monitoring and reporting solutions for GPs and LPs in PE, which enable the digestion of financial data in any format. This helps managers and their investors to automate and streamline portfolio monitoring, valuations, analyses, and reporting.

Chronograph recently raised funds from Summit Partners, with participation from Carlyle and Nasdaq Ventures. This funding has enabled the scale-up to double its workforce and continue innovating to meet the needs of its clients, particularly in ESG data management and interconnectivity between LPs and GPs.

Chronograph's platform monitors more than 6 trillion USD in PE and VC assets and is used by some of the world's largest investors.

otherwise…

Hillel and Valentine's recommendations this week:

The Making of the Atomic Bomb by Richard Rhodes

🎧 Listen here

Chronograph (🇬🇧)

Spotify / Google podcast / Deezer

FNZ (🇫🇷)

Spotify / Google podcast / Deezer

👋 Contacts

Pierre-Henri Denain / FNZ

Charlie Tafoya / Chronograph

Sources: FNZ, Chronograph, WSJ, PE Stack.